For many, the dream of home ownership seems out of reach. Between the high cost of homes, a competitive market, and the relative ease of renting in comparison to owning, it’s easy to see why people often remain reluctant—trapped in rental agreements for far longer than necessary.

And sure, buying a home can be expensive. It can be challenging. However, it can be equally as rewarding and yield long-term financial benefits many prospective homeowners forget about or fail to consider in the first place.

Don’t be that person. Sit tight, study up, and work with NAF Financial. We’ll help you uncover the true cost of home ownership.

Concerning Costs

Earlier this year, a study reported that 64% of millennials had at least one regret about buying a house. We could wax poetic about how the sample size was relatively small (there are a lot of millennials in the country, after all), but let’s take that percentage at face value for a minute: More than half of millennial homeowners have regrets about their decision to buy.

That’s a lot.

That list of regrets included many related to the financial aspects of purchasing. Some (12%) didn’t like the rate they got. Some (21%) weren’t prepared for maintenance costs. Some (13%) felt their monthly payments were too high. Others (13%) simply felt as if they paid too much for what they got.

Taking the data at face value, what can we infer from those reasons?

Too many people didn’t go into the process fully prepared, or—perhaps—lacked a deeper understanding of the cost of home ownership in comparison to renting.

That’s not okay, and that’s exactly why we’re here to help you (millennial or not) make a more informed decision before committing to your journey toward home ownership.

Reasons to Rent…or Not?

Right off the bat, one of the most appealing things about renting is the relative ease of doing so. You fill out an application, they run your credit, you sign some papers, and you move in. Depending on where you live, you might also benefit from access to amenities like a swimming pool, a gym, or a dog park.

Beyond that, renting is a totally valid solution for people in need of short-term living arrangements, people who are working on improving their credit (good for you), and people who aren’t in a financial position to save for a down payment.

When you rent, you’re tied to a consistent payment for a period of up to a year (longer, in some cases). Then, two to three months out from your renewal date, you get a letter from your landlord. If you want to renew, you’re going to pay more rent. In many cases, rent increases by 3–5% per year. If you can’t afford that, you begin the process anew—searching for a new home, paying new application fees and security deposits (not to mention the costs associated with moving).

If you do the math, those upfront costs can match or exceed what you’d pay, on average, if you had just renewed your lease and stayed put.

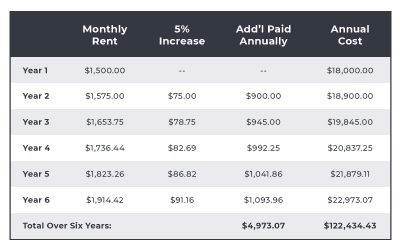

Let’s say you stayed put though. Let’s say you renewed your lease consistently for five years, committing to an increase of 5% per year. For a $1,500 apartment in year one, that’s an additional $900 over the course of your second year.

In addition to paying nearly $5,000 in additional rent, over a period of six years you would have shelled out more than $120,000—roughly ⅓ of the median cost of a home in the United States in 2021. Where’s that money going? Straight to your landlord, or whatever company managing the property you live on.

No equity. No credit. No sense of ownership.

Is seasonal access to a pool (that’s never as private as you’d like) and piecemeal maintenance work worth that much for a unit that’s never truly yours? We think not.

The Cost of Home Ownership

Some of the scariest costs of home ownership include the upfront costs like down payments, inspection and appraisal fees, and closing costs. Depending on your situation, you could be looking at a sizable chunk of change that’s due almost immediately.

Then you consider the ongoing costs of home ownership following the purchase. Remember, home warranties aside, you’re now responsible for maintenance costs like plumbing, landscaping, pest control, and HVAC work. Living in a community with a homeowner’s association? Go ahead and cough up those HOA dues too.

And while we can’t blame you for asking “Where’s it all end?”, we’d also caution you to reconsider your angle. These costs can be scary, but they don’t have to be.

- Plumbing repairs may be expensive, but those repairs just added equity to your home—one less thing the next owner, should you ever decide to sell, has to worry about.

- If you bought a home built in the 60s and upgraded its HVAC system, you’ve increased its value.

- If you replace the roof, you’re protecting the home from future damage.

- When you replace aging appliances and windows, you’re saving money on energy use.

Almost every dollar you put into your home is value added. Value you can take advantage of if or when you decide to sell or refinance.

Beyond that equity, there’s also the benefit of a consistent mortgage payment. Not for just one year, but for decades. Instead of paying an additional 3–5% in rent every year (plus repeated moving costs), you can now use that money for home improvement projects or save it for your next family vacation.

And, if those high upfront costs are still cause for concern, there are a variety of programs first-time homeowners can take advantage of for help—including down payment assistance and grants.

Consider the Pros & Cons:

| Renting Pros: – Covered maintenance – Included amenities | Buying Pros: – Costs less over time – Your property, your decisions |

| Renting Cons: – Annual rent increases – Lack of ownership/equity | Buying Cons: – Hefty upfront costs – Increased responsibility |

Decisions, Decisions

We’re not here to twist your arm. Ultimately, this decision is yours to make. If you’re in need of short-term living arrangements or if the idea of included amenities appeals to you, renting is a valid lifestyle. But if you’re looking to settle down and benefit from long-term consistency, we’d recommend buying.

And when it comes to figuring out how much you’ll pay either way, we recommend NerdWallet’s rent vs. buying calculator. It’s easy to use—just plug in a few numbers to find out how much you’ll pay over an extended period of time. You may be surprised to learn the cost of home ownership is often less expensive in the long run.

You may be surprised to learn the cost of home ownership is often less expensive in the long run.